Millennium is an independent fund services company providing a full range of administration services Read More

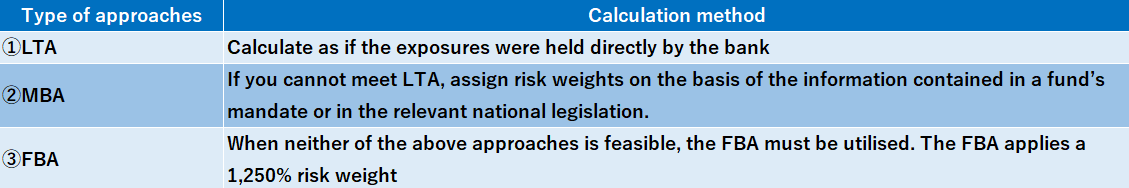

New policy framework for “Capital requirements for banks' equity investments in funds” of Basel committee was finalized as of Mar 2019. The framework agreed by the Committee consists of three approaches, with varying degrees of risk sensitivity: the “look-through approach” (LTA), the “mandate-based approach” (MBA), and the “fall-back approach” (FBA). The prudential framework comprises a hierarchy of approaches for banks’ equity investments in funds:

- (i) The LTA is the most granular approach. Subject to meeting the conditions set out for its use, banks employing the LTA must apply the risk weight of the fund's underlying exposures as if the exposures were held directly by the bank.

- (ii) The MBA provides an additional layer of risk sensitivity that can be used when banks do not meet the conditions for applying the LTA. Banks employing the MBA assign risk weights on the basis of the information contained in a fund’s mandate or in the relevant national legislation.

- (iii) When neither of the above approaches is feasible, the FBA must be utilised. The FBA applies a 1,250% risk weight to a bank's equity investment in the fund.

As noted above, if you cannot apply LTA and the budget is tight, you’ll not be able to make fund investments due to higher risk weighted assets.

・Regulatory reporting assistant service

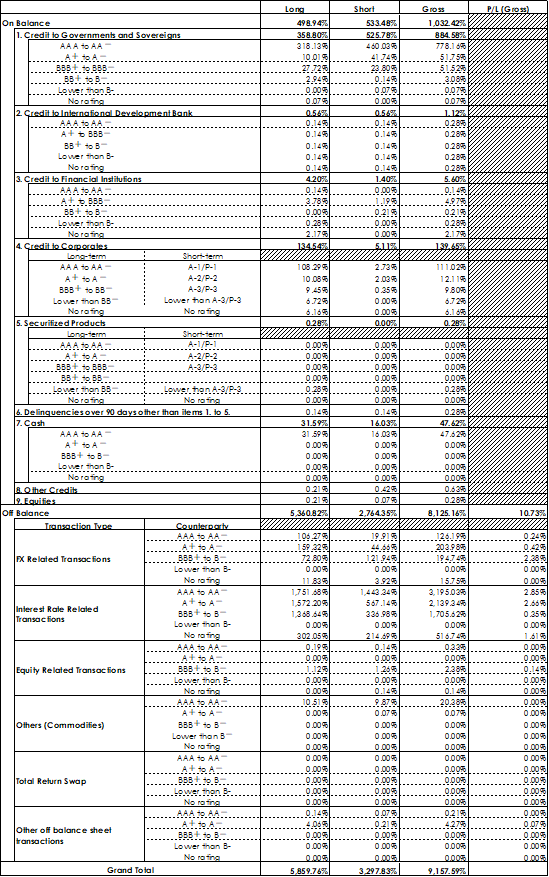

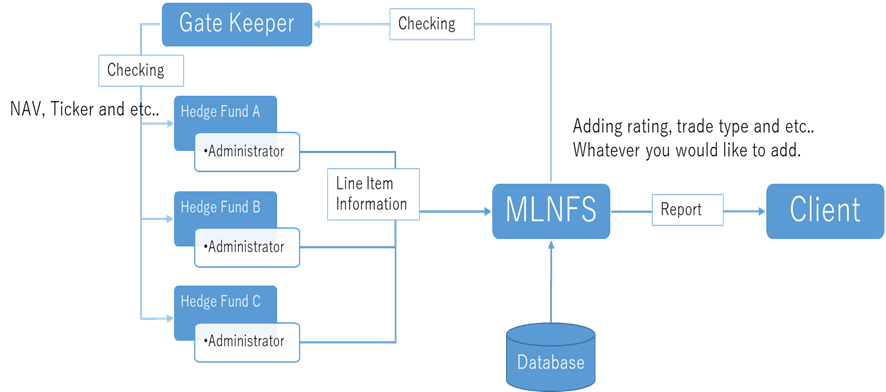

We can provide the reporting for both the Standardized approach and Internal Ratings-Based approach accordingly. We gather all the line item information and calculate the necessary values.

MLNJP has deep experience with off-shore funds.

We provide line item report and comprehensive report which is aggregated of line item one.

If you have specific template to be filled in, we can place values there as appropriate.

・The feature of MLNJP reporting

Will provide two reports as we mentioned above which is complied with Basel III.

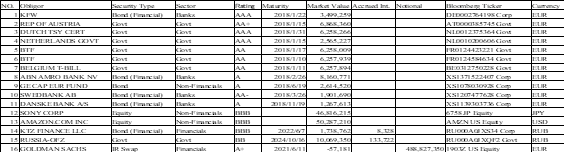

- 1.Line item report which includes all the position at certain time (normally quarter end)

- 2.Comprehensive report which is aggregated of #1 above

Will have deep discussion on how to populate your template if you have, how to calculate risk weights and etc. beforehand so that we could customize the report appropriately.

We’re in the hedge fund industry for more than 10 years so we have good record of data cleansing (each administrators or each managers have different data format) and will be able to provide the reports with reasonable price, which we think cannot be done by many firms.

Our clients are institutional banks which have high demand of the quality/types of reporting.